Your Cart is Empty.

- Step-by-step strategies, designed to teach you Theta’s powerful and risk mitigated strategy

- Online course access for 6 months

- Updates on financial markets and our trades

- Instant access to our online recorded training modules

- Continuing training and premium support

- Access to our private online community

Instant access to our online recorded training modules

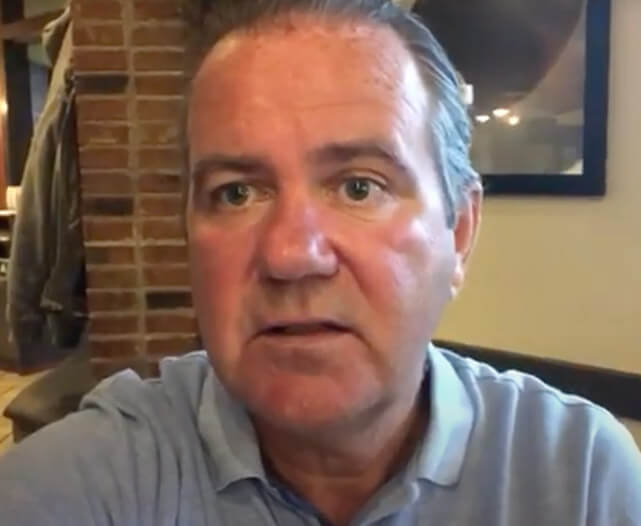

Matthew Todman

Co-Founder

Matthew Todman, CPA, CA, CFA brings 15+ years of financial services experience to the table. His early career began on Toronto’s Bay Street, at a Big Four accounting firm, before he moved on to a chartered Canadian bank, holding roles on the trading floor and in finance. Matthew then went into private practice, founding an accounting firm. Currently, he spends his time managing his accounting firm’s strategic direction, overseeing his real estate portfolio, trading derivatives, and building out Theta Trading.

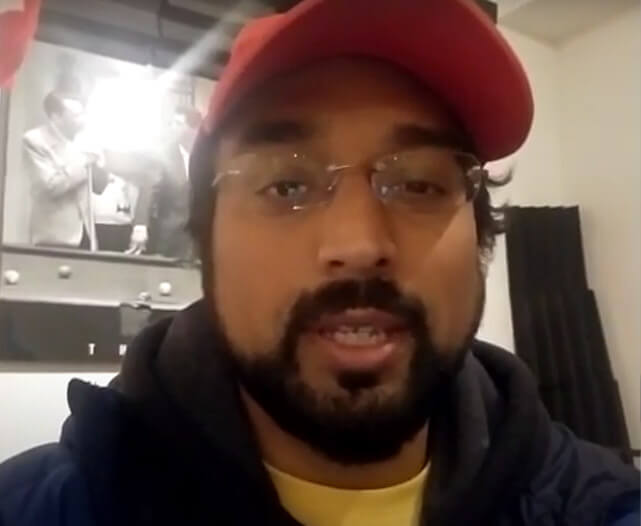

Omar Khan

Co-Founder

Omar Khan’s career spans more than 15 years in financial services. Starting out in the brokerage arm of a Big Five Canadian bank, he quickly rose through the ranks of the industry to AVP in a widely known mutual fund company. He then shifted his focus, becoming a full-time real estate investor and derivatives trader. Omar holds a BA in Economics from the University of Toronto. He currently spends his professional life trading derivatives, building his real estate portfolio, and promoting the core values of Theta Trading.

Stock Options Academy Intro Course

Financial markets overview

Financial markets in the US and Canada are huge. We take a look at the market we’re dealing with and why you should be interested in it.

Gaining the knowledge

We’ve all heard the saying that knowledge is power. Trading this is no different. The ability to digest news and estimate and act on its financial impact is a skill you’ll need. Our newsletter will help you.

Stock Selection

Make sure you want to own the stock. It’s something people say but what does it mean? We’ll show you the tools we use to choose what stocks we’re interested in.

Intro to derivatives

There are three categories of derivatives: futures, forwards and options. The world we’re speaking about is the options world. So let’s explore it.

Options in action

With some of the academic work behind us, we help you see how options work in a moving market.

Executing the strategy

Equipped with options knowledge, you can execute the strategy. It’s important to have a broker that offers mobile capabilities, along with the right data and analytics, so you can trade from anywhere in the world where there’s an internet connection.

Putting it together

Here’s where we consolidate our knowledge. Decisions relating to market assessments, underlying selection, risk assessments, option selection need to be made seamlessly and efficiently. We’ll teach you how.

Accounting and tax

This is a short section we cover that’s Canada-focused. Please contact your professional advisor(s) for accounting and tax advice.

Example scenarios

We take you through some world events that have had an impact on financial markets and we show you how to handle these situations.

Portfolio, funding and real estate

We discuss how real estate, businesses and financial markets trading connect with each other and how we use these asset classes together.

Entering the trade

In this section, we’ll show you how to enter an options trade using your smartphone. Our demo walks you through it.